Central Bankers Remain Resolute as Economies Weather Rate Hikes

- rabeelrana

- No Comments

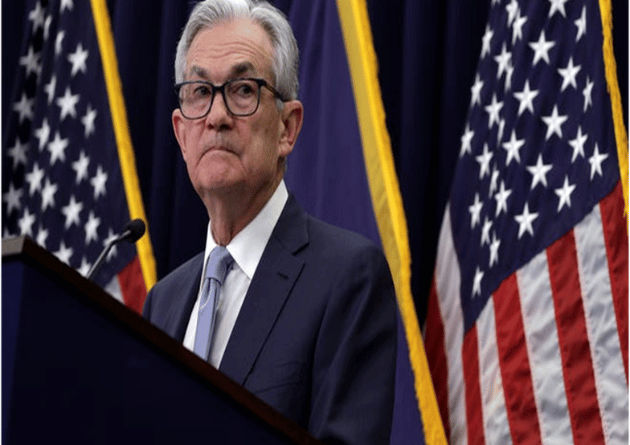

In a joint appearance at a panel discussion in Sintra, Portugal, top central bankers, including Federal Reserve Chair Jerome Powell, European Central Bank President Christine Lagarde, and Bank of England Governor Andrew Bailey, reiterated their commitment to curbing high inflationary pressures. Despite a series of interest rate hikes, the global economy has shown surprising resilience, prompting central bankers to promise more measures to rein in inflation. The officials expressed concerns about the persistence of high inflation and its potential to become entrenched in the economy. They emphasized that taming inflation was their top priority, even if it meant enduring some economic challenges in the process.

Federal Reserve Chair Jerome Powell highlighted that although current monetary policy was restrictive, it might not be sufficient or in place for a long enough period to effectively address inflationary pressures. Powell suggested the possibility of raising interest rates at two consecutive meetings after a recent pause, with most Fed policymakers expecting at least two more rate increases this year. The central bankers’ aim is to bring inflation down to their respective targets and prevent it from becoming a persistent issue in the economy. Economists’ projections indicate a slowdown in headline inflation, primarily due to a decline in gasoline prices. However, core inflation, which is considered a more accurate indicator of underlying trends, is expected to remain unchanged. Powell has expressed concern that core inflation would persist at high levels until 2025 if not addressed promptly. The central bankers also pointed to the tightness of their countries’ job markets as a contributing factor to inflationary pressures, acknowledging its dual role as both a strength for the overall economy and a potential fuel for inflation. The Fed will have another glance of the inflation in the US via Core PCE Price Index on Friday. While the central bankers expressed caution and acknowledged the possibility of a recession as a result of their actions, they maintained that it was not their base case scenario. Powell and Bailey emphasized the need to monitor the situation closely, with the Bank of England stating that they are not currently forecasting a recession but would remain vigilant. The central banks recognize that their economies might have to endure tough times to achieve their primary goal of taming inflation.

Central bankers, including Jerome Powell, Christine Lagarde, and Andrew Bailey, have been surprised by the global economy’s resilience despite multiple interest rate increases. However, they remain determined to address high inflationary pressures and prevent it from becoming entrenched in the economy. Expressing concerns about the persistence of inflation, they prioritize taming it as their primary focus. Despite potential economic challenges and the risk of a recession, central bankers reaffirm their commitment to implementing additional measures to achieve their inflation targets and ensure long-term economic stability.