Fed Hikes Interest Rates 0.25 Percentage Point But Signals Pause In Inflation Fight

- rabeelrana

- No Comments

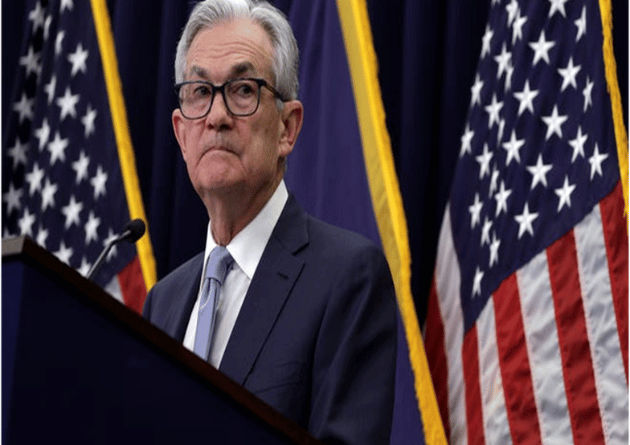

True to the market expectation, Federal Open Market Committee (FOMC) raised the fed rate by 0.25%. After the rates were announced the greenback pulled back against the major currencies as the FED president suggested the end in rate hikes is soon.

The key takeaways from the FOMC were that they will take decision regarding pausing and/or pivot on a meeting by meeting basis. Whereas the 25 basis point rate increase was unanimous. FED also pointed out that the inflation was still persistent along with the labor market which is still tight and it will take some time for the market to fully incorporate the rates hikes, hence the data regarding these two would be closely watched by the FED. Powell also answered questions regarding the banking crisis saying the conditions in the sector have improved and the banking system is sound and resilient. The FED believes that the effects of rate tightening is seen in the housing and investments sector.

He pushed back on market assumptions that the FED would cut rates this year, by maintaining that say such a move was unlikely. Jerome Powell commented that inflation will eventually come down to their target levels but it will take some time. According to the CME Fed Watch tool after this statement predicted a 91% chance of a rate pause in the June FOMC meeting. However the market is still pricing in that rate cuts would happen in the third quarter of this year, this is where the FED differs.

Overall this FOMC meeting was as expected by the market, with 0.25% increase in rates and a dovish tone, the key change in Powell statement from the previous press conference was that now they will be determining whether future rates are compulsory, instead using anticipating that further rate hikes will be necessary.