Japanese Yen Set to Record Strongest Weekly Performance in 15 Months

- rabeelrana

The Japanese yen retreated in Asian trading on Friday against a basket of major and minor currencies, easing from a two-week high versus the U.S. dollar. The pullback was driven by corrective positioning and profit-taking, alongside renewed strength in the dollar ahead of the release of key U.S. inflation data.

Despite the decline, the yen remains on course to record its strongest weekly performance in 15 months its largest gain since November 2024. The currency has been supported by a robust wave of buying following the landslide electoral victory of Japan’s ruling party under Prime Minister Sanae Takaichi.

Investors view Takaichi’s decisive mandate as enhancing her ability to pivot policy emphasis from short-term spending toward sustainable growth. Market participants are increasingly betting that her strengthened political position will allow for more fiscally disciplined measures and improved management of downside risks in Japanese government bonds.

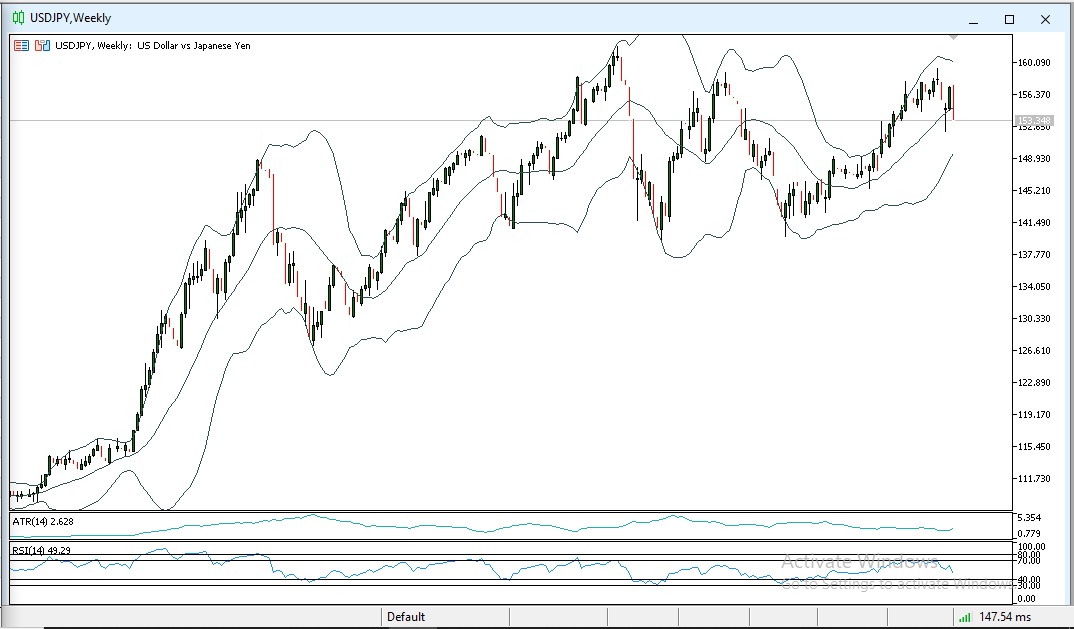

The dollar rose 0.4% against the yen to 153.35, up from an opening level of 152.71, after touching an intraday low of 152.64. On Thursday, the yen had gained approximately 0.35% against the dollar its fourth consecutive daily advance reaching a two-week high of 152.27 amid easing financial concerns in Japan.

The U.S. dollar index advanced 0.1% on Friday, extending gains for a fourth straight session as the currency rebounded from two-week lows against a basket of global peers. Stronger-than-expected U.S. labor market data have reduced expectations that the Federal Reserve will cut interest rates as early as March. Investors are now focused on the release of January’s key U.S. inflation data, which could further reshape interest rate expectations.

Takaichi’s overwhelming electoral victory has bolstered investor confidence in her capacity to implement growth-supportive fiscal policies while addressing cost-of-living pressures. At the same time, her strengthened mandate is seen as enabling a more measured and responsible use of stimulus tools aimed at controlling deficits and stabilizing public debt growth. Analysts suggest that a more coherent and disciplined economic strategy under Takaichi could ease lingering financial concerns and reinforce confidence in Japan’s broader economic trajectory.

Market-implied probabilities indicate less than a 10% chance that the Bank of Japan will raise interest rates by 25 basis points at its March meeting. Investors are awaiting further data on inflation, unemployment, and wage growth to reassess expectations for future policy adjustments.