Markets Trading In A Narrow Range As Traders Awaiting For The Us Gross Domestic Product

- rabeelrana

- No Comments

The upcoming US economic events, namely the Advance GDP report on Thursday, April 27th, the FOMC Statement on Wednesday, May 3rd, and the Non-Farm Payroll (NFP) Jobs report on Friday, May 5th, are likely to have a significant impact on the EUR/USD currency pair.

The Advance GDP report will provide insights into the health of the US economy and its growth prospects, and any surprise figures may lead to market volatility. The FOMC Statement will give clues regarding the Federal Reserve’s monetary policy outlook, including interest rates and inflation, and traders will scrutinize it for hints on potential changes. Lastly, the NFP Jobs report is a key indicator of the US labor market’s health and can cause a significant market reaction if it deviates significantly from expectations.

The EUR/USD currency pair is likely to experience increased volatility and directionality, depending on the outcome of these events. A better-than-expected Advance GDP report or a hawkish tone in the FOMC Statement may strengthen the US dollar and push the pair lower. Conversely, a weaker GDP figure or a dovish FOMC Statement, along with strong NFP Jobs report, may put downward pressure on the dollar, leading to a rise in the EUR/USD pair. Overall, traders and investors will closely monitor these events and adjust their positions accordingly.

The EURUSD increased 0.06% to 1.1048 on Tuesday April 25 from 1.1041 in the previous trading session. In Europe, the ECB is set to deliver two more 25 bps rate increases by mid-year to combat inflation. While the headline inflation in the Euro Area was the lowest in 13 months in March, both core and food inflation hit fresh records. Earlier this month, ECB’s Klaas Knot said it was unclear whether 50 bps or 25 bps would be needed. At the same time, Robert Holzmann backed another 50 bps move, while Peter Kazimir considered slowing down the pace of tightening.

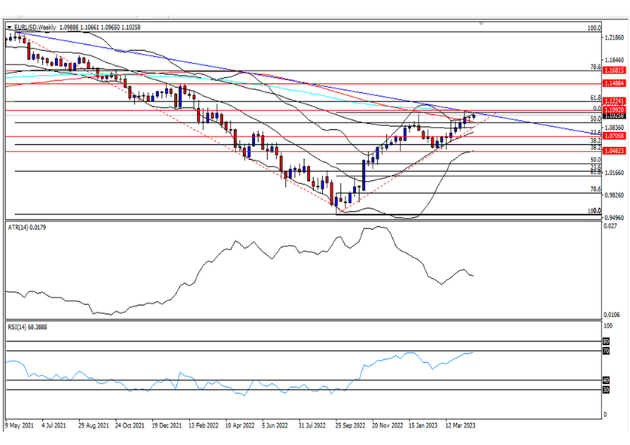

EURUSD is being traded on 1.1037 on April 25, 2023 at 1430 HRS PKT the pair is likely to face Weekly Trend Line & 200 Day Simple Moving Average resistance at 1.1090 although a breakage and close above this resistance level can soar EURUSD till 1.1225 or 1.1490.

Although a failure to break this Weekly Trend Line & 200 Day Simple Moving Average resistance at 1.1090 EURUSD may plunge towards 1.0710 & 1.0485.

Although indicator Relative Strength Index (RSI) in period 14 in weekly timeframe is showing that prices are near to reach over bought territory as current RSI in 68.4